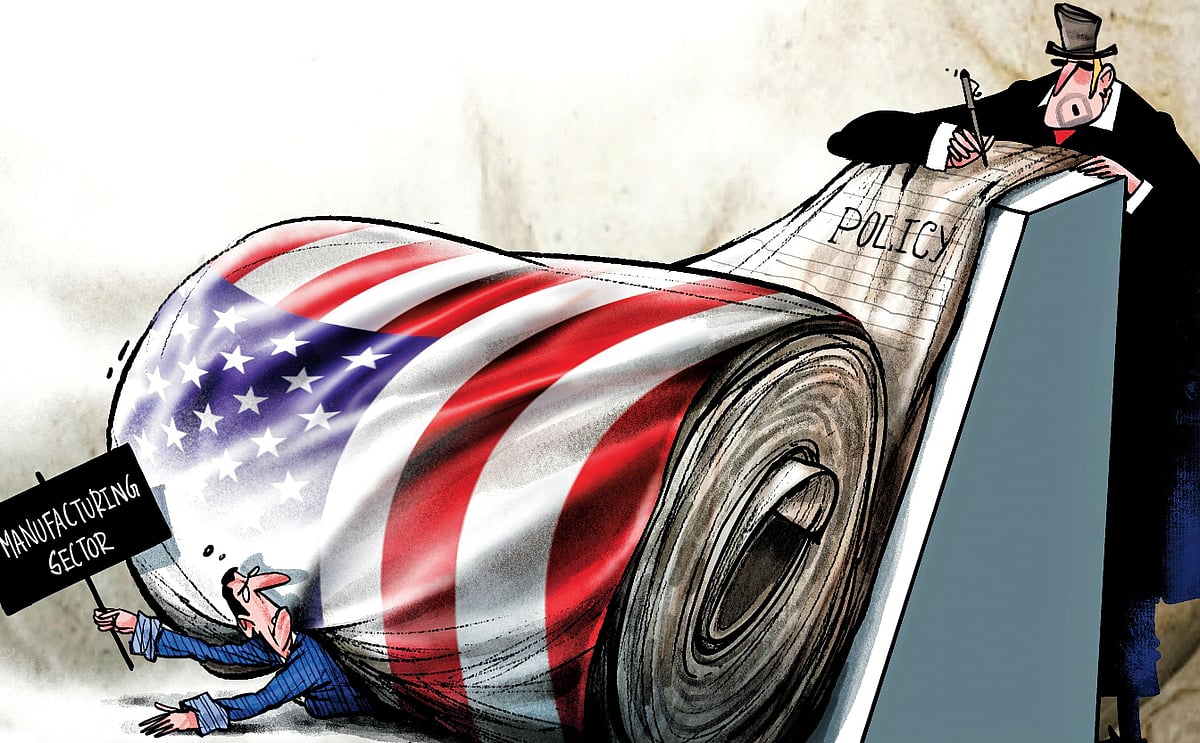

America’s decline in manufacturing was not inevitable—it was a choice. In the late 20th century, policymakers prioritised low interest rates and financial speculation over industrial strength. By keeping borrowing cheap and the dollar strong, they diverted capital into Wall Street, consumer debt, and stock buybacks rather than factories, worker training, or technological advancement. This short-term thinking hollowed out the economy, making any attempt to revive traditional manufacturing a near impossibility. America’s future now lies in embracing the digital economy and empowering small businesses—sectors far better suited to modern realities.

The genesis of American deindustrialisation resides in the late Cold War-era consensus that conflated financial market vitality with national economic strength. The Federal Reserve’s strong-dollar policies controlled inflation and attracted foreign investors, but they also made American goods uncompetitive abroad, leading to an influx of cheaper imports. Manufacturing struggled to keep pace.

An appreciating currency rendered US exports prohibitively expensive abroad while flooding domestic markets with cheap imports, eviscerating profit margins for industries from textiles to semiconductors. Concurrently, the Clinton-era embrace of financial deregulation—such as repealing the Glass–Steagall Act, which aimed to protect depositors from the risks of commercial banks’ speculative investments, in 1999—encouraged corporations to focus on stock buybacks and mergers instead of upgrading equipment or training workers.

The consequences were stark. Between 1998 and 2010, the US haemorrhaged a third of its manufacturing jobs—5.8 million positions—as firms fled to jurisdictions with weaker currencies and lower labour arbitrage. Crucially, this offshoring was not in response to exogenous competition, but a rational reaction to endogenous policy failures. Washington’s refusal to recalibrate monetary policy or invest in advanced manufacturing ecosystems left industry starved of capital and political support.

Unlike Germany, which built resilient networks of small manufacturers, America neglected infrastructure, education, and supply chains. Later leaders tried tariffs and ‘Made in America’ campaigns, but these failed to address the core issues: uncompetitive industries, spiralling debt, outdated infrastructure, weak worker training, and corporate monopolies.

Fantasy of reviving factories

The digital economy has fundamentally reshaped global power structures. Today, companies like Apple and Google thrive on intellectual property, AI, and cloud computing—not physical production. Apple’s $2.7-trillion valuation stems from its software, services, and branding rather than factory output—a stark contrast to the 2.4 percent profit margin typical of contract manufacturers like Foxconn. Google’s dominance lies in AI-driven products rather than tangible goods.

Trying to bring back factories is akin to reviving flip phones. Kodak invented digital photography but clung to film, leading to bankruptcy. GM had the opportunity to lead in electric vehicles but let Tesla take the market. Even if America were to spend trillions rebuilding factories, the reality is that automation has dramatically reduced traditional job opportunities. Robots handle much of the work now, and the labour required for mass production is minimal compared to previous decades.

Furthermore, replicating China’s industrial model is unrealistic. China’s rise as a manufacturing powerhouse took over 40 years of state-backed investment, cheap labour, and extensive infrastructure development. Competing with this would mean slashing wages, dismantling environmental protections, and enduring years of financial losses—none of which are viable strategies.

The future: Small businesses

Politicians often promise to restore “good factory jobs”, but the reality is that modern factories rely heavily on automation, limiting employment opportunities and wage growth. The true economic engines of today are small and medium-sized enterprises (SMEs), which generate more employment, innovation, and tax revenue than large corporations.

SMEs account for 99.9 percent of all businesses in China, employ nearly half of all private-sector workers, drive innovation and provide 60 percent of the taxes collected. Small businesses invent 16 times more patents per employee than big corporations. SMEs create the solutions they need—for example, companies like Shopify and Square enable small businesses to sell products globally, opening new opportunities that traditional factories cannot provide.

Around the world, SMEs are driving economic transformation. In Kenya, M-Pesa’s mobile banking system helped 500,000 small businesses secure loans. In Colombia, startups leverage apps like Rappi to reach international markets. These businesses thrive by using digital tools to find niche customers and scale effectively—not by trying to compete with massive industrial conglomerates.

If America wants to remain competitive, it must repair the damage inflicted by decades of flawed policies. The current workforce is unprepared for modern economic challenges—over half of US adults struggle with basic literacy, while China graduates five times more STEM students than the US. Wall Street speculation continues to drain resources from productive industries, with the derivatives market ballooning to $1.2 quadrillion.

So, here are a few solutions.

Shift economic focus: Instead of chasing manufacturing nostalgia, invest in small business technology, clean energy, and STEM education.

Modernise trade rules: Form global agreements for e-commerce, data privacy, and digital payment systems to help smaller enterprises expand internationally.

Regulate Wall Street speculation: Tax high-speed stock trades and separate high-risk investments from traditional banking.

America’s manufacturing sector did not collapse because of China—it collapsed because policymakers favoured Wall Street over Main Street. Trying to revive a 20th-century industrial model in the face of automation and global supply chain shifts is not only misguided, but dangerous. The future belongs to small businesses and the digital economy.

America must choose: lead this transition by fostering innovation, infrastructure, and education, or stagnate as an outdated economy clinging to past paradigms.

Einar Tangen,

Senior Fellow at the Taihe Institute and Chairman of Asia Narratives Substack

(Views are personal)